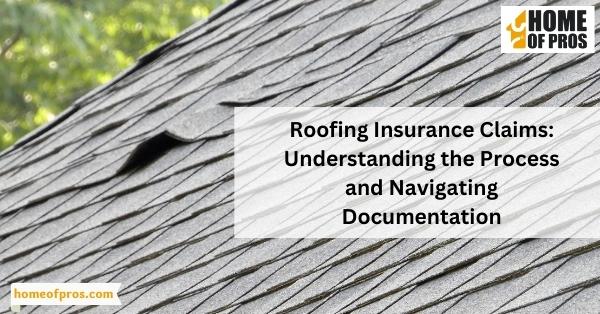

When it comes to roofing insurance claims, being adequately covered is essential. While it may seem like an added expense to your homeowners’ insurance policy, having the right coverage for your roof can save you significant amounts of money and stress in the long run. From severe weather damage to falling debris, unforeseen events can wreak havoc on your roof, making insurance claims crucial in offsetting repair or replacement costs.

In this blog post, we will provide an overview of the roofing insurance claims process and guide you through each step, from filing a claim to navigating the paperwork involved. With this information, you can get your roofing repair or replacement cost covered without any hassle.

Roofing Insurance Claims and Why They Are Important

As a homeowner, it’s crucial to realize the importance of roofing insurance claims. While it may seem like an added expense to your homeowners’ insurance policy, having adequate coverage for your roof can save you significant amounts of money and stress in the long run.

Roof damage caused by unforeseen events like severe weather or falling debris can be costly to repair or replace, but insurance claims can help offset those expenses. Additionally, insurance companies often require regular roof inspections and maintenance to remain covered, which can help identify and prevent potential issues before they become more significant problems.

Ensuring that your roof is properly insured can provide peace of mind and financial protection for you and your home.

Documentation Requirements for Roofing Insurance Claims

Necessary paperwork and documents for filing a claim

Filing a claim for roofing insurance can be a daunting task, but with the proper documentation, the process can go smoothly. First and foremost, you’ll need a copy of your insurance policy and the date on which the incident occurred.

Additionally, it’s important to have photographs of the damage to your roof along with an estimate of the repair costs from a qualified roofing contractor. Any receipts for temporary repairs or proof of payment for those repairs should also be included in your claim.

It’s also recommended to keep a record of any communication with your insurance company, including emails and phone calls, to ensure there is no miscommunication during the claims process. By having all of the necessary documents in order, you can rest easy knowing that you’re taking the right steps to ensure a successful insurance claim.

How to obtain the necessary paperwork and documents

Filing an insurance claim for roof damage can feel overwhelming, especially when it comes to providing the necessary paperwork and documents. To ensure a smooth process, it’s important to gather all relevant information and documentation before filing your claim.

First, obtain a detailed estimate or inspection report from a licensed roofing contractor. This should include a breakdown of the damages and costs. Additionally, gather photos or videos of the damage, as well as any receipts or invoices related to repairs or replacements.

Your insurance company may also require proof of ownership, such as a property deed or mortgage statement. By gathering all the necessary paperwork and documents, you can streamline the insurance claims process and increase your chances of a successful outcome.

Understanding the language of insurance claims and how to interpret it

Insurance claims can often be a daunting task, especially when it comes to filing for documentation requirements for roofing claims. However, it is important to understand the language of insurance claims and how to interpret it in order to file a successful claim.

To begin, it is essential to carefully review your insurance policy and understand the terms and conditions outlined within it. Once you have identified the specific coverage for your roofing, you can begin documenting any damages and gathering evidence to support your claim.

Additionally, it is crucial to understand the language and terminology used by insurance companies when evaluating your claim, such as “actual cash value” and “replacement cost.” With a clear understanding of the language and requirements, you can confidently file a roofing insurance claim that accurately reflects your damages and receives just compensation.

Step-By-Step Process for Filing a Roofing Insurance Claim

- Assess the damage: Before filing a claim, check your roof for any visible damage. Look for missing or cracked shingles, dents on metal roofs, or any other signs of damage.

- Review your insurance policy: Understand your insurance coverage and deductible. Your insurance policy will determine what is covered and how much you’ll be reimbursed.

- Contact your insurance company: Reach out to your insurance company as soon as possible. They will guide you through the claims process and provide you with the necessary paperwork to file a claim.

- Document the damage: Take photos and videos of the damaged areas, and make notes of the date and time of the damage.

- Meet with an adjuster: Your insurance company will assign an adjuster to assess the damage. Be sure to point out all the damage you found during your initial assessment.

- Get repair estimates: Get at least three repair estimates from licensed and insured contractors. Submit these estimates to your insurance company to ensure that they are fair and reasonable.

- Wait for approval: Your insurance company will review your claim and determine whether to approve it or not. Once approved, they will issue a payment for the repairs.

- Hire a contractor: Choose a reputable contractor to complete the repairs. Ensure they are licensed and insured before signing a contract.

- Complete the repairs: Have the contractor complete the repairs, and ensure they are done to your satisfaction.

- Follow up with your insurance company: Keep your insurance company updated on the progress of the repairs, and provide them with any documentation they request.

Tips on Filing a Successful Roofing Insurance Claim

- Document the damage: Take pictures and videos of the damage to your roof as soon as possible after the incident. This will help provide clear evidence of the damage to your insurance company.

- Review your policy: Make sure you understand what your insurance policy covers and what it doesn’t cover. You should also review your deductible, which is the amount you’ll have to pay out-of-pocket before your insurance kicks in.

- Contact your insurance company: Notify your insurance company as soon as possible after the incident. They will guide you through the process of filing a claim.

- Get an estimate: Have a professional roofing contractor assess the damage and provide an estimate for repairs or replacement. This will help ensure that the insurance company has accurate information about the cost of the damage.

- Keep track of all communication: Make note of all phone calls, emails, and other correspondence with your insurance company. This will help ensure that you have a record of everything that’s been discussed.

- Be patient: The insurance claim process can take time, so be patient and follow up regularly with your insurance company to check on the status of your claim.

- Consider hiring a public adjuster: If you’re having trouble getting your claim approved, you may want to consider hiring a public adjuster. They can help negotiate with your insurance company on your behalf.

In Conclusion

Roofing insurance claims can be an overwhelming process. Understanding the basics of filing a claim and having the necessary paperwork and documents is crucial for a successful outcome. By ensuring your roof is properly insured, documenting the damage, understanding your policy’s coverage, obtaining estimates from contractors, and keeping track of all communication with your insurance company, you will be in a better position to file a successful claim.